Basic Approach

The Takamiya Group believes that the basic foundation for sound corporate governance consists of thoroughly enforcing compliance, ensuring the transparency and efficiency of management, and working to maximize corporate value for all stakeholders, including shareholders and investors.

With the stable supply of safe, high-value-added temporary equipment as our base axis, we will conduct high-quality corporate activities, and focus on efforts to improve the status of the industry, not just for the development of our own group, but for the benefit of customers and the industry as a whole.

We will build a temporary equipment industry that is clearly recognized for its excellence by both the general public and investors, and aim for sustainable development in a highly transparent business environment.

Corporate Governance Structure

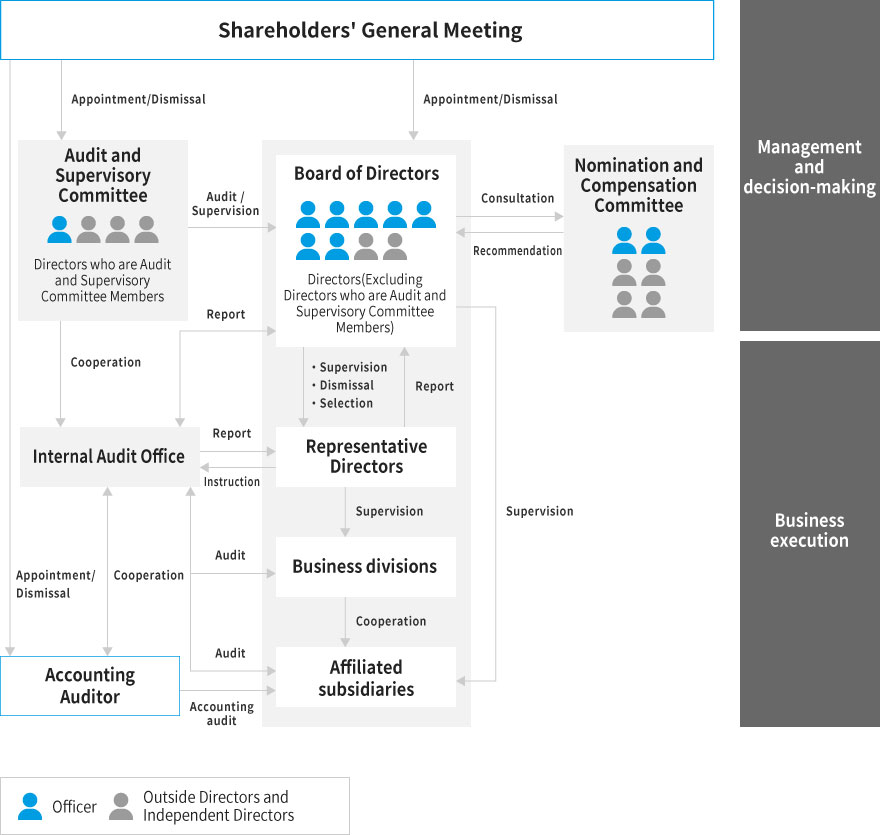

Our Board of Directors is composed of 9 directors, excluding those serving on the audit and supervisor committee member. The board includes members with diverse expertise, backgrounds, and experiences. Additionally, two independent outside directors and three directors serving as independent outside members of the audit and supervisor committee regularly attend, providing unbiased and candid opinions, advice, and feedback on management matters from an independent and objective standpoint.

Furthermore, to enhance the independence, objectivity, and accountability of the functions of the Board of Directors related to the nomination and remuneration of executive management, we have established an optional Nomination and Remuneration Committee as an advisory body to the Board of Directors. This committee is composed of four or more outside directors, with a majority being independent outside directors or directors serving as independent outside members of the audit and supervisor committee. The committee chair is elected from among the independent outside directors by resolution of the committee, ensuring transparency and objectivity in the decision-making process of our Board of Directors.

| Organizational Structure/Audit and Supervisory Committee/Companies with Nomination and Remuneration Committees Established. |

Audit and Supervisory Committee/Companies with Nomination and Remuneration Committees Established |

| Chairman of the Board of Directors/Representative Director, President and Chairman/Kazumasa Takamiya |

Representative Director, President and Chairman/Kazumasa Takamiya |

| The number of members on the board of directors |

9 members, including 2 outside directors |

| The number of members on the Audit and Supervisory Committee |

4 members, with 3 of them being outside directors serving as members of the Audit Committee |

The status of the Board of Directors meetings for

the fiscal year ending March 2025. |

Regular meetings held 12 times, and special meetings held 5 times.

Written resolutions: 3 times. / Director attendance rate: 100%, Audit Committee attendance rate: 90%. |

| The status of the Audit and supervisory Committee for the fiscal year ending March 2025. |

Regular meetings held 12 times, special meetings held 1 times, and the attendance rate of the Audit and supervisory Committee member was 95% |

The main important meetings attended by

audit and supervisory committee members |

Board of Directors, Audit and supervisory Committee, Nomination and Remuneration Committee, Management Meetings |

| The appointment of independent directors |

Two outside directors and three outside directors serving as members of the audit and supervisory committee. |

| Accounting Auditor |

ARK LLC |

(Note) The Audit and supervisory Committee was established in June 2022.

Director & Audit

The status of directors who are also members of the Board of Directors and the Audit and supervisory Committee.

The structure of the Board of Directors

- (Note) Director Kazuhaku Kawakami was appointed at the 54th Regular Shareholders' Meeting held on June 23, 2022, and as a result, the number of attendances at the Board of Directors meetings differs from other directors. The number of Board of Directors meetings held after his appointment is 12.

- (Note) The Audit and supervisory Committee was established in June 2022.

The composition of the Audit Committee.

- (Note) Director Sachie Kato was appointed at the 54th Regular Shareholders' Meeting held on June 23, 2022, and as a result, the number of attendances at the Board of Directors meetings differs from other directors. The number of Board of Directors meetings held after his appointment is 12.

The criteria for appointing directors

The appointment and dismissal of candidates for directors and directors who are Audit and Supervisory Committee members are determined by a meeting of the Board of Directors after consulting with and receiving recommendations from the Nomination and Compensation Committee, based on relevant regulations including the Regulations for Professional Organization of Officers and the Nomination and Compensation Committee Regulations. Comprehensive consideration is given to the career history, track record, knowledge, experience, and capabilities of each candidate. Furthermore, the consent of the Audit and Supervisory Committee is obtained in advance for the appointment of candidates for directors who are Audit and Supervisory Committee members.

Selection Criteria

1. Directors

The basic requirements for director candidates are having outstanding character and insight, as well as being such individuals that will contribute to the growth and improvement in the corporate value of the Company and the Group. The candidates must have high levels of knowledge and judgment capabilities in each business field. Outside director candidates are required to have a high level of expertise in a field such as taxation, accounting, law, or management. They must be able to actively state opinions from an objective and external viewpoint, reflecting a diverse background.

2. Audit and Supervisory Committee Members

The basic requirements for Audit and Supervisory Committee member candidates are having high ethical standards and objective, fair, and impartial judgment capabilities. The candidates must also have the appropriate experience and capabilities as directors who are Audit and Supervisory Committee members and a high level of expertise in a field such as taxation, accounting, law, or management. In addition to the above requirements, candidates for outside directors are required to have no conflicts regarding their independence.

For the dismissal of officers, if an officer has deviated from the above appointment criteria and it is deemed reasonable to dismiss them from an objective viewpoint, a resolution shall be made at a meeting of the Board of Directors after the Board has sufficient discussions, and consults with and receives recommendations from the Nomination and Compensation Committee.

The Selection and Dismissal of the Chief Executive Officer

Our company has established an optional Nomination and Remuneration Committee, and for the selection and dismissal of the President, who is the Chief Executive Officer, decisions are made by the Board of Directors after consultation and recommendations are received from the Nomination and Remuneration Committee.

Succession Plan

The Company does not currently have a specific plan for successors for positions such as chief executive officer. However, we recognize succession planning as an important management issue and we are nurturing candidates from the management team (directors and executive officers). We will continue to engage in constructive discussions on the approach to the appropriate implementation and supervision of succession planning at meetings of the Board of Directors and its advisory body, the Nomination and Compensation Committee, which was established on April 21, 2021.

Officers

Evaluations of the Effectiveness of the Board of Directors

Regarding the concurrent positions of our directors in other companies, it is stipulated in the "Board of Directors Regulations," and we consider it within a reasonable range that does not hinder the proper execution of their roles and responsibilities as directors of our company. Based on attendance records at the Board of Directors and other business performance indicators, the situation of concurrent positions is within a reasonable range. Detailed information on this situation is disclosed in our business reports, shareholder meeting reference materials, and securities reports.

The Company has conducted questionnaires with directors regarding the effectiveness of the Board of Directors in the fiscal year ended March 31, 2023. We analyze and evaluate the structure and operations of the Board of Directors as well as the role of the Board of Directors in management strategy decisions and the supervisory function.In the fiscal year ended March 31, 2023, while there was room for improvement, such as discussions on the successor development plan and the opinion that it is necessary to further enhance the training of directors, it was deemed that the Board largely maintains its effectiveness. Going forward, we will further improve the effectiveness of the Board of Directors based on these analyses and evaluations.

Remuneration for Directors and Audit and Supervisory Committee Members

The Policy Regarding the Determination of Remuneration and Other Compensation for Officers, Including the Amount or Calculation Method

The Company has established a policy regarding the determination of the amount of remuneration for officers or its calculation method, which states that the officer remuneration consists of fixed remuneration according to their position, performance-linked remuneration (bonuses) as a short-term incentive linked to single-year performance, and stock-based remuneration stock options positioned as a medium- to long-term incentive. Through thorough evaluation based on the interests of shareholders, we are working to ensure the long-term sustainable growth of the entire Group and enhance corporate value. Meanwhile, the remuneration of outside officers consists only of basic remuneration from the perspective of their roles and independence.The retirement benefits for officers were abolished as of the 43rd Regular Shareholders' Meeting held on June 29, 2011.

1. Fixed remuneration

The method for determining the fixed remuneration of directors is as follows: within the limit of the total remuneration amount for directors determined by the resolution of the general shareholders' meeting, the President and CEO comprehensively assesses the position, duties, and performance of each director, taking into account the overall company performance. After consulting with the Nomination and Remuneration Committee and receiving their recommendations, the matter is deliberated and decided upon by the Board of Directors. The remuneration for each director is determined by considering the evaluation of their position and duties, company performance, and the level of employee salaries. This allows for the possibility of an increase based on the achievements of the previous fiscal year, designed to reward the accomplishments of each officer.

2. Performance-based remuneration

The short-term performance-linked bonus, which is an annual bonus, is determined within the limit of the total compensation amount for directors resolved at the general meeting of shareholders when the consolidated operating profit target for the fiscal year is achieved. The compensation level is considered by benchmarking against companies of similar business scale and in related industries and sectors. After consulting with and receiving recommendations from the Nomination and Remuneration Committee, the Board of Directors deliberates and decides on the bonus. The reason for selecting this indicator is to encourage each director to have a broad perspective beyond their assigned areas and to be conscious of efficient group management.

3. Medium- to long-term incentive (stock options)

Stock-based remuneration stock options, which are a medium- to long-term incentive, are granted based on the position factor set in the Company’s regulations within the limit of the total amount of stock options provided for in a resolution by the General Meeting of Shareholders. The respective proposals for bonus payment and granting stock options are submitted to the Board of Directors, which determines and grants the bonuses and stock options after consulting with and receiving recommendations from the Nomination and Compensation Committee.

The authority to determine the policy for the amount or calculation method of remuneration for our company's officers has been delegated to the President and CEO by resolution of the Board of Directors. This decision was made based on the judgment that it enables a proper evaluation of each director.

Furthermore, in determining the amount of remuneration for our company's directors in the current fiscal year, the opinions of external directors and external auditors are considered. The President and CEO then reviews the matter, proposes it for discussion at the Board of Directors, and makes the final decision. It should be noted that the Nomination and Remuneration Committee has been established since April 21, 2021.

Our company does not have a specific policy for determining the ratio of performance-linked compensation to non-performance-linked compensation in the remuneration of our officers.

In the current fiscal year, the target for the performance-linked compensation indicator was a consolidated operating profit of 3,600 million yen, and the actual achievement was 2,061 million yen. Based on this performance indicator, performance-linked compensation was not paid in the current fiscal year.

The total amount of compensation for each executive classification, the total amount of compensation by type, and the number of executives eligible for compensation.

- The total remuneration for directors who concurrently serve as officers of consolidated subsidiaries does not include the officer remuneration from the consolidated subsidiaries.

- The Company transitioned from a Company with a Board of Corporate Auditors to a Company with an Audit and Supervisory Committee on June 23, 2023.

- It was resolved that the limit on directors’ remuneration (excluding Directors who are Audit and Supervisory Committee Members) shall be up to an annual amount of ¥500 million (up to \50 million for outside directors; not including employee salaries for directors) at the 54th Ordinary General Meeting of Shareholders held on June 23, 2022 (number of Officers in relation to the said resolution: 9).

In addition, it was resolved that the limit on separate remuneration as stock options shall be up to an annual amount of ¥150 million (excluding Directors who are Audit and Supervisory Committee Members and outside directors) at the 54th Ordinary General Meeting of Shareholders held on June 23, 2022 (number of officers in relation to the said resolution: 7).

- It was resolved that the limit on remuneration for Directors who are Audit and Supervisory Committee Members shall be up to an annual amount of ¥50 million at the 55th Ordinary General Meeting of Shareholders held on June 23, 2023. Remuneration for individual Audit and Supervisory Committee Members are determined by discussion of Audit and Supervisory Committee Members (number of officers in relation to the said resolution: 4).

- It was resolved that the limit on corporate auditors’ remuneration before the transition to a Company with an Audit and Supervisory Committee shall be up to an annual amount of ¥50 million at the 25th Ordinary General Meeting of Shareholders held on May 18, 1994 (number of officers in relation to the said resolution: 3).

The total amount of consolidated compensation for each executive.

Director's training

While we provide opportunities for directors to acquire the knowledge necessary for the execution of their duties and to stay updated on the business environment, we are currently considering the development of a systematic training plan to ensure that directors can fulfill their roles and responsibilities effectively in accordance with the expectations placed upon them, taking into account the dynamic nature of the business environment.

We plan to appropriately utilize external institutions for training on corporate governance, compliance, sustainability, and other related matters.

Skill matrix

we identify the capabilities required to realize our business strategy. Based on this, we create a skill matrix for directors, taking into consideration a comprehensive balance of knowledge, experience, and abilities necessary for the effective fulfillment of the roles and responsibilities of the board of directors.

Communications with Shareholders and Investors

We are committed to providing timely information to shareholders and investors with a foundation of transparency, fairness, and continuity.

We strive to disclose information in compliance with the timely disclosure rules and proactively provide effective information to enhance understanding of our company.

We are actively working to expand the shareholder and investor base by promoting understanding of our business activities, strategies, and performance through direct communication. Specifically, we conduct meetings with analysts and institutional investors and hold earnings briefings. Additionally, we make videos and materials (in Japanese and English) from the earnings briefings publicly available. We enhance transparency through internet disclosure of meeting notices (in Japanese and English) and conduct informative sessions for individual investors. The key achievements in our investor relations activities for the fiscal year ending in March 2023 are as follows.

Other matters related to corporate governance

The status of the internal control system and risk management framework implementation

Risk management structure

Our group has established a basic policy in the Risk Management Basic Rules, outlining fundamental principles and essential matters related to risk management. In order to ensure accurate management and practices regarding various risks associated with our business, we have established a Risk and Compliance Committee with the Legal and Compliance Office as its secretariat. This committee discusses issues and countermeasures related to promoting comprehensive risk management throughout the entire organization.

Compliance structure

Our group has established compliance standards and a code of conduct in the Compliance Manual. We have set up a Risk and Compliance Committee with the Legal and Compliance Office as the secretariat, where we discuss specific initiatives for internal compliance and legal issues. We aim to promptly grasp internal legal issues, enhance awareness and permeation of compliance, and further strengthen efforts towards compliance with laws and regulations. Additionally, as needed, we seek advice and guidance from legal advisors on daily operations and management decisions

The status of establishing a framework to ensure the appropriateness of the business operations of subsidiaries

To ensure the appropriateness of our group's operations, each company within our group regularly holds group company meetings and conducts an annual group alliance meeting. We report monthly business performance and important resolutions as needed. Furthermore, matters related to the general meetings of shareholders and resolutions of the boards of directors of each company within our group are deliberated in our company's board of directors. Additionally, the internal audit department conducts internal control audits and business audits for each company within our group.

Internal Control

For internal control, we have developed a system in which internal checking operates between departments and clarifies the division of duties by establishing internal regulations and other rules. In addition, the Basic Policy for Internal Control and the Basic Policy for Financial Reporting outline systems to ensure that the directors comply with laws and the Articles of Incorporation when conducting operations, and also to ensure properness of other operations of the Company.

Internal Control Basic Policy

Our company, based on the Company Act and its enforcement regulations, establishes the following framework (internal control) to ensure the appropriateness of our company's and our company's subsidiaries' business operations. Hereinafter, the term "our company and our company's subsidiaries" will be referred to as the "our company group."

Overview of the Limited Liability Contract

Our company and each external director and audit and supervisor committee member who is a director have entered into a contract to limit the liability under Article 427, Paragraph 1 of the Companies Act, based on the limitation of liability stipulated in Article 423, Paragraph 1 of the same Act. The limit of liability under this contract is set at the minimum limit specified in Article 425, Paragraph 1 of the Companies Act.

Please note that the limitation of liability is recognized only when the director in question has not committed good faith and gross negligence in the performance of the duties that led to the liability.

Number of Directors Allowed

Our company's articles of incorporation stipulate that the number of directors shall be four or more and shall not exceed fifteen.

Resolution Requirements for the Appointment of Directors

Our company's articles of incorporation specify that a resolution for the appointment of directors requires the presence of shareholders who hold at least one-third of the voting rights exercisable at the general meeting and that the resolution is passed by a majority of the voting rights present, without relying on cumulative voting.

Authority for Determining Dividends and Surplus Distributions

Our company, regarding matters specified in Article 459, Paragraph 1 of the Companies Act concerning the distribution of surplus, except when otherwise provided by law, has stipulated in its articles of incorporation that the distribution of surplus shall be determined by the resolution of the Board of Directors, not requiring a resolution from the general meeting of shareholders. This can be carried out annually with a reference date of either March 31 or September 30. By granting the authority for the distribution of surplus to the Board of Directors, the aim is to ensure flexibility in financial strategy and stability in the management foundation.

Acquisition of Own Shares

Our company has stipulated in the articles of incorporation that, in accordance with the provisions of Article 165, Paragraph 2 of the Companies Act, the Board of Directors can decide to acquire the company's own shares. This is intended to enable the implementation of a flexible capital policy in response to changes in the business environment, with the purpose of acquiring the company's own shares through market transactions and similar means.

Exemption of Director's Liability

Our company has stipulated in the articles of incorporation that, by resolution of the Board of Directors, the liability of directors under Article 423, Paragraph 1 of the Companies Act can be exempted. If the conditions specified by law are met, the amount of liability can be exempted up to the amount obtained by subtracting the minimum limit set by law from the liability amount. This is intended to create an environment in which directors can fully demonstrate their abilities and fulfill their expected roles when performing their duties.

Requirements for Extraordinary Resolution at the General Meeting of Shareholders

Our company has stipulated in the articles of incorporation that, regarding the requirements for an extraordinary resolution at the general meeting of shareholders as specified in Article 309, Paragraph 2 of the Companies Act, the presence of shareholders holding more than one-third of the voting rights exercisable at the general meeting, and the resolution requires approval by more than two-thirds of the voting rights. This is intended to facilitate the smooth operation of the general meeting of shareholders by relaxing the required quorum for special resolutions.

Directors and Officers Liability Insurance Contract

Our company has entered into a Directors and Officers Liability Insurance contract as stipulated in Article 430-3, Paragraph 1 of the Companies Act with an insurance company. The scope of the insured under this insurance contract includes directors (including external directors), and the insured parties bear the insurance premiums. The insurance contract aims to compensate insured parties for damages and litigation expenses incurred due to claims for compensation resulting from wrongful acts carried out by insured parties based on their positions. However, certain actions, such as bribery and intentional illegal acts by officers themselves, are excluded from coverage to ensure the appropriateness of the execution of their duties.